Talbot Financial – 2Q 2020 Review

2020 has been filled with uncertainty and anxiety, largely driven by the pandemic. As we navigate this territory, our first concern remains with you, your families, and the communities in which you live. Covid-19 and the recent issues around social injustice have created new challenges in our neighborhoods and nation. As your financial team, we want to reassure you that we are monitoring and managing your investment portfolio with these challenges in mind.

Although we cannot predict exactly what the future holds, we can assure you that we are studying the trends and analyzing the data for the best outcomes we can provide for your investments. As we see the closure of some of the long-standing corporations like JC Penney and Neiman Marcus, we are reminded of the following quote from the late Andy Grove, former CEO Intel Corporation:

“Bad companies are destroyed by crises, good companies survive them, great companies are improved by them.”

We remain optimistic that the positioning of the companies you own in your portfolio are the ones that will not only survive but thrive during this disruptive period. These companies have exceptional balance sheets, strong cash flows and outstanding management teams; and therefore, will tend to gain market share from competitors not ready to react to the swift and dramatic need to adjust.

One way that we can support you over the next few months is to review your portfolio either by phone or on a Zoom conference. We invite you to contact us for a review, or just answer any questions you may have about your portfolio.

Investment and Economic Review

Please find attached your Talbot Financial second quarter 2020 portfolio review to supplement your monthly account statements available from Schwab. The report provides a performance summary of your investment portfolio compared to the S&P 500 Total Return Index (“Index”), Talbot Financial’s benchmark, and lists your investment portfolio holdings by industry sector.

Extraordinary levels of government stimulus spending and policies in the U.S. and around the world propelled second quarter equity market returns. For the quarter, the Index increased 20.5%, representing a material rebound from the lows in the financial markets in late March. Performance was led by the Consumer Discretionary and Technology industry sectors. In fact, all industry sectors had positive performance returns for the quarter. For the year-to-date period through June 30, 2020, the Index declined 3.1%, following a 31.5% gain in the Index in 2019.

The near-term consequence of the pandemic is a deep, but relatively short (in our opinion) U.S. recession, defined as two consecutive quarters of contraction in Gross Domestic Product (GDP). First quarter GDP contracted 5% and analysts estimate a 30% contraction for the second quarter GDP. Estimates for the remainder of the year then gradually return to positive territory and forecast a strong rebound in 2021.

In spite of current economic levels and investor sentiment, we see reasons for optimism regarding the economy and the equity markets, including:

Economic activity is picking up. Certain leading activity indicators have improved off their lows, including miles driven, hotel occupancy, airline travel miles and mortgage purchase activity. Additionally, after bottoming in the February through April time period, employment, consumer spending, housing, and manufacturing have all started to rebound.

Global government stimulus is unprecedented. First, central banks have made it clear maintaining low borrowing costs and high liquidity will remain top priorities. Second, governments initiated countless spending and investment plans to bridge the gap until economies return to normal post the pandemic. To date, the U.S. government pledged $2.4 trillion in benefits, grants, relief, direct aid, and tax breaks to U.S. consumers, small and big business, and state and local governments.

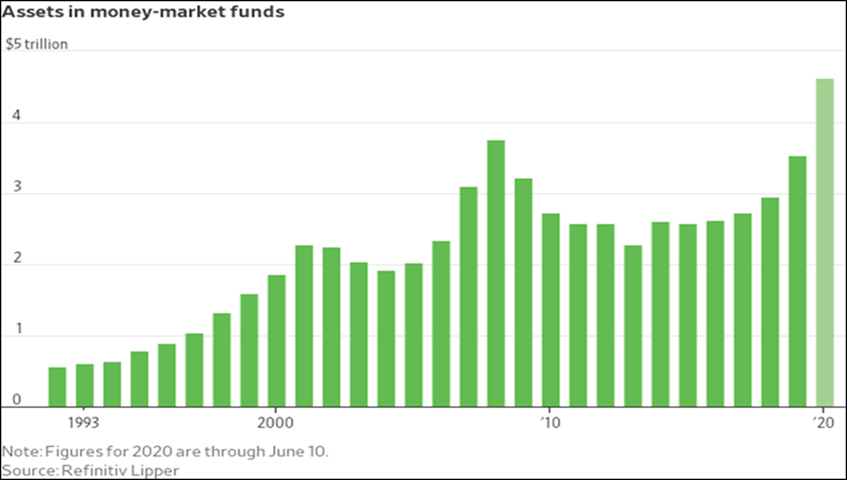

Cash on the sidelines is at a record high. The table below illustrates assets in money market funds were $5 trillion in mid-June. As some of this cash flows back into the equity markets, it should serve as a catalyst for equity returns.

As evidence of the aforementioned quote by Andy Grow regarding “great companies are improved by them (crises),” consider the following since the pandemic began:

Amazon’s online stores grew first quarter revenue at 24%. Conversely, through the first six-months of the year traditional brick-and-mortar retailers announced 8,700 stores closures. The growing list of announced retail bankruptcies include JC Penney, Neiman Marcus, GNC, Brooks Brothers and Pier 1 Imports.

Starbucks took what it learned early on in the pandemic in its stores in China and applied the knowledge to further leverage its competitive advantage relative to smaller peers in the U.S. and the rest of the world.

During Microsoft’s first quarter earnings call, CEO Satya Nadella stated that “we’ve seen two-years of digital transformation in two-months,” thereby, widening the advantage of firms that have embraced cloud computing. Microsoft’s revenues continue to grow at a nice pace.

On a year to date basis, the S&P 500 Index, representing the largest capitalization companies, has outperformed the Russell 2000 Index, representing small capitalization companies, by a margin of over 10%. The largest, most diversified companies have taken market share this year.

Our view is the U.S. and the rest of the developed world are gradually working through the economic recession, and our commitment to remain invested in industry leading companies with strong secular growth opportunities offers the right mix between investment risk and potential investment reward.

Be well,

Talbot Financial, LLC

www.talbotfinancial.com