Talbot Financial – 3Q 2020 Review

Please find attached your Talbot Financial third quarter 2020 portfolio review to supplement your monthly account statements available from Schwab. The report provides a performance summary of your investment portfolio compared to the S&P 500 Total Return Index (“Index”), Talbot Financial’s benchmark, and lists your investment portfolio holdings by industry sector.

For the third quarter, large company U.S. stocks, as measured by the Index, posted a return of 8.9%. This follows a 20.5% gain for the second quarter and marks the best two-quarter market return since 2009. Furthermore, the Index has recovered 51.7% from the market low on March 23, led by the Technology, Consumer Discretionary and Communications Services sectors.

The strength of the market rebound was the result of two primary drivers. First, the accommodative nature of both monetary and fiscal policy. Second, the steady reopening and improvement of the economy as consumer spending, manufacturing and employment consistently moved upward. From the April lows through the end of September, the economic recovery has been V-shaped. In the coming months and quarters, we expect to see a continued, but more subdued economic recovery.

As investors, our two near-term concerns are the uncertainties related to the upcoming election and the lingering economic ramifications of the COVID-19 virus.

Financial markets do not like uncertainty. Therefore, it is expected that we will see increased market fluctuations through the election in early November. Despite the potential for volatility in the near-term, our view is that no matter the outcome of the election, it will not have a negative impact on economic growth or longer-term financial market returns. There is historical data from 16 elections dating back to 1947 that supports this perspective and demonstrates that whether control in the executive and legislative branches of the U.S. government is Republican, Democratic, or divided, the economy grew, as measured by real gross domestic product (GDP), and stock market returns were positive. Our job is to invest in companies we believe will be successful in the years ahead, regardless of political environments or election outcomes.

With regard to our concerns related to the pandemic’s prolonged impact on the economy, the development response for a COVID-19 vaccine is unprecedented. For perspective, according to the World Economic Forum it historically has taken two to five-years to develop a vaccine and then another three to five-years to move through the three phases of clinical trials. In contrast, the vaccine discovery for COVID-19 began in January and currently there are over 50 vaccines in clinical trials, with 11 already in phase 3 trials. Most importantly, the medical experts expect a vaccine to be approved within the coming months. Thus, a continued economic recovery seems likely given the considerable resources and financial support in place for the global distribution of the vaccines.

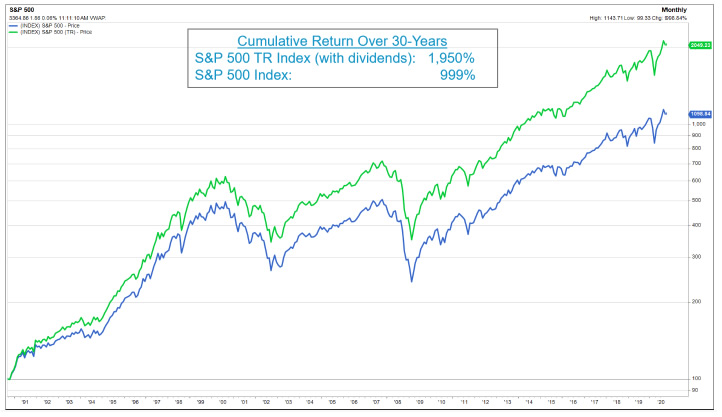

We perpetually advocate the importance of “time in the market”, versus “timing the market.” Our philosophy is to invest in industry leading companies with the financial resources to pay dividends to shareholders, as well as raise dividends over time. Following is a chart to illustrate the profound financial benefit of dividends to total returns on an investment portfolio over the long run. The chart compares the return of the S&P 500 without dividends reinvested (blue line) to the return of the S&P 500 with dividends reinvested (green line) over a 30-year period.

The difference between the two, almost 1000% over the trailing 30-years, represents the value of the payment and re-investment of dividends over the long-term.

Although your Talbot Financial investment portfolio is not simply the Index, the above analysis is relevant because your portfolio has a dividend yield similar to the Index. Over the long-term, the payment and growth of portfolio dividends have a substantial compounding effect on the growth of your portfolio. In summary, it has proven valuable to invest in tremendous companies that consistently pay and increase their dividends, and then let those dividends compound over time.

We would welcome the opportunity to review your portfolio either by phone or on a Zoom conference. Please contact us for a review, or to answer any questions you may have about your portfolio.

Be well,

Talbot Financial, LLC

www.talbotfinancial.com