Talbot Financial – 2Q 2018 Review

Trade wars, the threat of higher inflation, and interest rate decisions by central banks dominated the financial media headlines in the second quarter. However, it was the continued strength of the U.S. economy and corporate earnings that were the most relevant factors to investors. Talbot Financial’s benchmark index, the S&P 500 Total Return Index (“Index”), increased 3.4% for the second quarter. The Index was down 0.8% for the first quarter of the year; and therefore, through the first half of the year the Index increased 2.6%.

Second quarter Index returns were led by a rebound in the Energy sector, which followed several years of relative underperformance. Technology was another sector leader for the quarter, an industry we have long over-weighted driven by our conviction of the sustainable positive impact of technology advancements driven by cloud computing. The Financial sector was the notable laggard during the quarter over concerns banks will have trouble expanding margins with a flattening yield curve.

As of the end of second quarter, we are 108-months into an economic expansion, making this the second longest expansion since World War II. That said, the rate of the expansion is the slowest on record, with Gross Domestic Product (GDP) growing at a cumulative average of just 2.3% over this period. The Conference Board, a group of independent businesses and research associations, recently forecast a 3.3% ramp in GDP for the second quarter and 3.5% for the remainder of the year. The drivers for the higher estimates were tax fueled consumer spending and corporate America capital spending. The jobs market is also strong. May 2018 unemployment was 3.8%, a low not seen since December of 1969. This is beginning to show up in wage growth figures, although wage growth remains below historic norms. Inflation finally started ticking-up, with the Personal Consumption Expenditure registering a 2.3% increase in May of this year.

U.S. corporations are returning cash to shareholders like never before. For the one-year period ending March 31, 2018, U.S. corporations returned over $300 billion to shareholders in the form of share repurchases and dividends. This figure likely increased further during the second quarter with the repatriation of overseas earnings following the recent tax law changes. We believe we are in the early innings of repatriation fueled share repurchases.

This record level of the return of capital is good news because a key tenet of our investment philosophy is we like our investment holdings to “pay us” while they work. That is, exclusive of sales and earnings growth, we want the companies we own to pay us both directly (via dividends) and indirectly (via share repurchase) for holding their shares. We refer to this as a “return of capital.” This is a primary reason we currently favor being overweight financial institutions, including banks.

The Federal Reserve recently released their “Comprehensive Capital Analysis Results,” the second round of 2018 stress testing of financial institutions. The analysis included a review of the capital return plans for the institutions for the coming year. The results included 34 of 35 banks receiving approval to move forward with their capital plan.

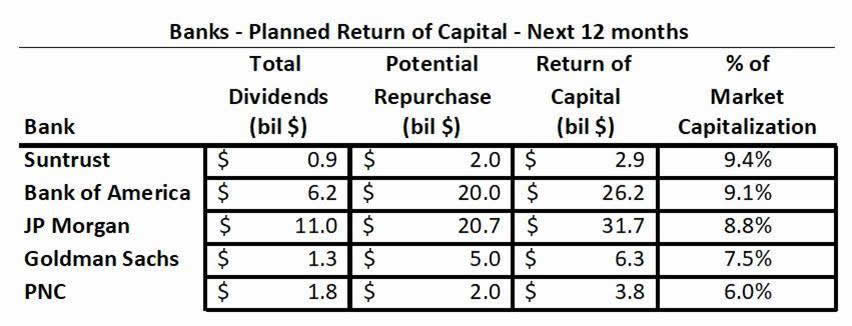

The following table summarizes the capital plans for five banks broadly held in Talbot Financial client portfolios:

As an example, JPMorgan received approval to pay out $11.0 billion in dividends and repurchase $20.7 billion of stock, for a combined total of $31.7 billion of capital to be returned to shareholders. This figure represents 8.8% of the total value of the company. As you can see from the table, these five banks intend to return between 6% and 9.5% of capital to shareholders over the next twelve-months. Importantly, our examination of past results shows that banks typically follow through on these capital return plans. In summary, we like to own companies that provide shareholders with these proposed levels of capital returns.